ABN Amro Creditcard Direct In 2020 Aanvragen (Makkelijk)

Moody's announces completion of a periodic review of ratings of ABN AMRO Bank N.V. Moody's Investors Service 13 Aug 2020 Issuer Comment ABN AMRO Bank N.V.: Q2 2020: ABN AMRO reports a €5 million loss and announces a complete overhaul of its CIB activities. For credit ratings that are derived exclusively from an existing credit rating of a.

How to Login ABN AMRO Credit Card 2023? YouTube

Credit rating agencies periodically review our creditworthiness and publish credit ratings for ABN AMRO Bank as well as for different classes of debt instruments. Credit ratings, reports and research are accessible in this section. ABN AMRO provides the press releases and credit research for information purposes only.

Netherlands ABN AMRO Bank mastercard credit card template... in 2022 Mastercard credit card

Strong Credit Profile: ABN AMRO Bank N.V.'s ratings reflect its strong domestic universal banking franchise, complemented by a solid European private banking foothold. The bank's strong capitalisation and sound funding and liquidity profile are rating strengths. The ratings also consider ABN AMRO's well-executed strategy, good asset quality and.

BBCnn News Apply for ABN AMRO Credit Card Make My Bill Payment Online

As reflected in the assigned Asset Risk score of a3, we consider ABN AMRO's asset quality to be good overall because its operations are primarily traditional retail and commercial banking in the domestic market. As of the end of September 2020, 60% of the bank's loan 3 22 January 2021 ABN AMRO Bank N.V.: Update to credit analysis

ABN Amro Banks & Credit Unions Leidseplein 25, Centrum, Amsterdam, NoordHolland, The

Find the latest ratings, reports, data, and analytics on ABN AMRO Bank N.V.

ABN AMRO Bank Card Redesign on Behance

Strong Credit Profile: ABN AMRO Bank N.V.'s ratings reflect its strong domestic universal banking franchise, complemented by a solid European private banking foothold. The bank's strong capitalisation and sound funding and liquidity profile are rating strengths.. ABN AMRO Bank N.V. Rating Report │ 26 October 2020 fitchratings.com 2 Banks

ABN AMRO Bank prend une participation dans la grande startup de données ThetaRay The Times of

ABN AMRO Bank N.V. - Update. Thu 20 Oct, 2022 - 11:25 AM ET. Strong Credit Profile: ABN AMRO Bank N.V.'s ratings reflect its strong domestic banking franchise, complemented by a solid European private banking foothold. The bank's strong capitalisation, funding and liquidity are rating strengths. The ratings also consider ABN AMRO's well.

ABN AMRO Zakelijke Rekening review en kosten ZZP Daily

DBRS Ratings GmbH (DBRS Morningstar) confirmed the Long- and Short-Term Issuer Ratings of ABN AMRO Bank N.V. (ABN AMRO or the Bank) at A (high) / R-1 (middle). The trend on all ratings remains Stable.. and ESMA regulations in the United Kingdom and European Union, respectively, this is an unsolicited credit rating. This credit rating was not.

Abn Amro Credit Spread Movement PDF Bond Credit Rating Credit

Strong Standalone Credit Profile: ABN AMRO Bank N.V.'s ratings reflect its strong and fairly diversified universal banking business model, complemented by a solid European private banking foothold, and its moderate risk profile, which results in resilient asset quality. The bank's capitalisation, funding and liquidity are rating strengths.

Quantum leap for banks as ABN AMRO questions gold price discovery

S&P Global Ratings affirmed the A/A-1 long- and short-term issuer credit ratings of ABN Amro Bank NV, with the outlook revised to stable from negative.. Ratings said it expects ABN Amro's additional loss-absorbing capacity to stay above 8% of its measure of risk-weighted assets by the end of 2022,.

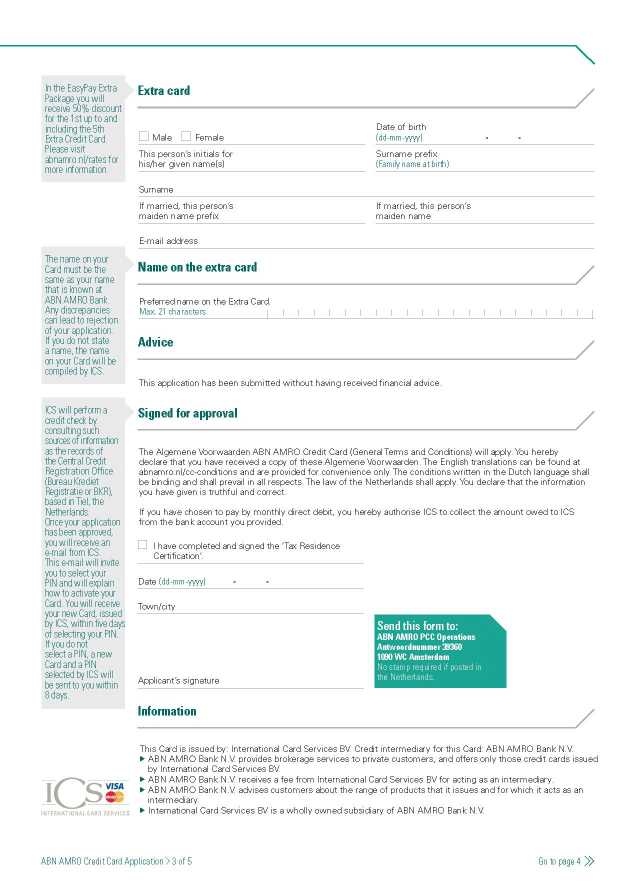

ABN AMRO Creditcard aanvragen + vergelijken NÉT nog besteld

ABN AMRO Bank N.V. Outlook Revised To Negative On Weaker Expected Earnings Amid COVID-19 Outbreak; Ratings Affirmed. Dutch-based ABN AMRO Bank N.V. announced in late March 2020, amid intense market volatility, that it will book about €180 million in net loss related to its usually low-risk clearing activities as part of its first-quarter results.

ABN Amro Creditcard Info & Tarieven (2024)

ABN AMRO Bank N.V. - Update. Fri 12 Apr, 2024 - 11:11 AM ET. Strong Standalone Credit Profile: ABN AMRO Bank N.V.'s ratings reflect its strong and fairly diverse universal banking business model, complemented by a solid European private banking foothold, and its moderate risk profile, which results in resilient asset quality.

ABN AMRO Creditcard Apps on Google Play

Fitch Ratings - Paris - 15 Nov 2022: Fitch Ratings has affirmed ABN AMRO Bank N.V.'s Long-Term Issuer Default Rating (IDR) at 'A' with a Stable Outlook and Viability Rating (VR) at 'a'. A full list of rating actions is below.. International scale credit ratings of Financial Institutions and Covered Bond issuers have a best-case rating.

ABN Amro Money laundering probe forces Danish bank boss resignation Peoples Gazette Nigeria

Credit ratings assigned to ABN AMRO Bank NV as of September 2023 are shown in details in the following sections. Fitch. Long-term issuer default rating is Fitch's view of a credit institution's relative vulnerability to default on its financial obligations, for ABN AMRO Bank NV it is set to A (high credit quality), outlook is stable (not likely.

Abn Amro Youth Growth Account Review Kids Aged 12 To 18 Finder Nl

ABN AMRO Bank N.V. Update following the upgrade of the senior unsecured ratings Summary The baa1 Baseline Credit Assessment (BCA) of ABN AMRO Bank N.V. (ABN AMRO) reflects the bank's overall good financial fundamentals including sound asset risk, strong solvency, improved profitability and a robust liquidity and funding position. The BCA.

Apply ABN AMRO Credit Card India 2023 2024 EduVark

ABN AMRO Bank N.V. Outlook Revised To Stable; 'A/A-1' Ratings Affirmed; Hybrids And Subordinated Debt Ratings Lowered February 26, 2021 Overview - We expect Dutch bank ABN AMRO Bank N.V.'s (ABN AMRO's) additional loss-absorbing capacity (ALAC) to stay above 8% of our S&P Global Ratings' risk-weighted assets (RWAs) by end-2022,

- Rhona Mitra In Hollow Man

- Pro Tour Beach Volleyball 2023

- Noord Korea Zegt Nooit Sorry

- Naar Welke Club Gaat Ronaldo

- Vooruitzicht Goede Tijden Slechte Tijden

- Heeft Psv Ooit De Champions League Gewonnen

- Rob Van Den Berg Overleden

- Lorrie Van De Blauwe Bergen

- Kniertje Op Hoop Van Zegen

- Promo Code For Viva Aerobus