7 things to know before owning a car in the Netherlands in 2023 DutchReview

Avoiding BPM tax. One of the downsides of having a car in the Netherlands is the tax! You are subject to VAT, BPM ( private motor vehicle and motorcycle tax ), and import duty tax when importing your car. However, you can easily avoid paying BPM tax if this is the first car you take with you to the Netherlands.

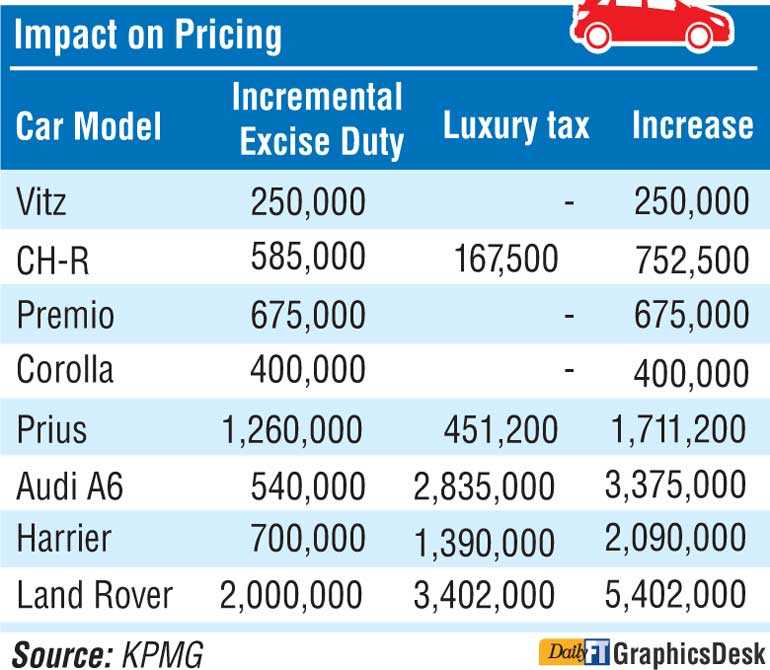

Luxury tax to make car prices exorbitant Daily FT

If you have a motor vehicle registered in your name, for example, a car or a motorcycle, you do not have to submit a separate motor vehicle tax (motorrijtuigenbelasting, MRB) declaration. Registering the vehicle in your name is your declaration. You then receive a payment notice from the Belastingdienst (Tax and Customs Administration). This indicates the amount of motor vehicle tax you must pay.

The Dutch Tax and Customs Administration (Belastingdienst) will let you know how much bpm you need to pay. After you have paid, the Netherlands Vehicle Authority (RDW) sends you the vehicle registration card within 5 working days. If you do not pay the bpm, you may be imposed an administrative fine as well as a retrospective tax assessment.

Car taxes in the Netherlands TraXall Nederland

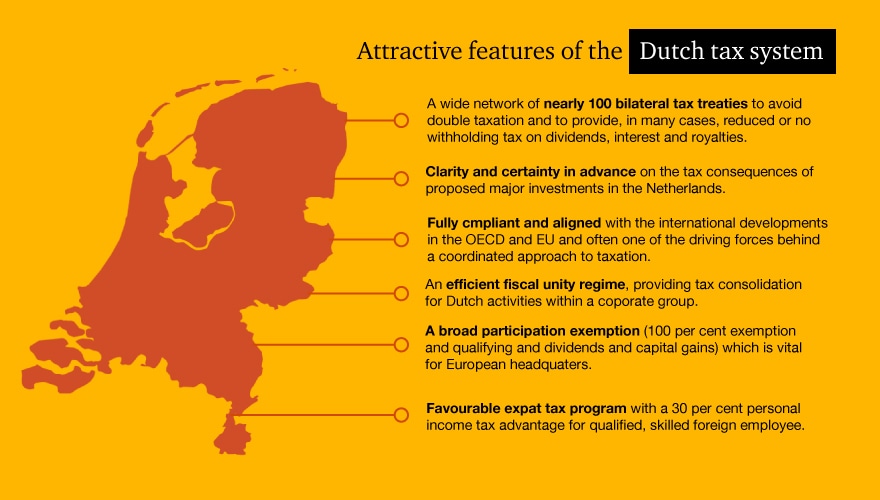

The 30% tax ruling is the main tax advantage for skilled expats coming to the Netherlands. It provides a tax-free allowance of up to a maximum of 30% of their salary. The maximum term of the 30% ruling is 5 years and expats will need to meet certain criteria to be entitled to it.

Road tax in the Netherlands

Motor vehicle tax. If you are registered in the Netherlands and you own vehicles you are required to pay motor vehicle tax. Vehicles are cars, vans, motorcycles, trailers, busses and lorries. In this section we explore more.

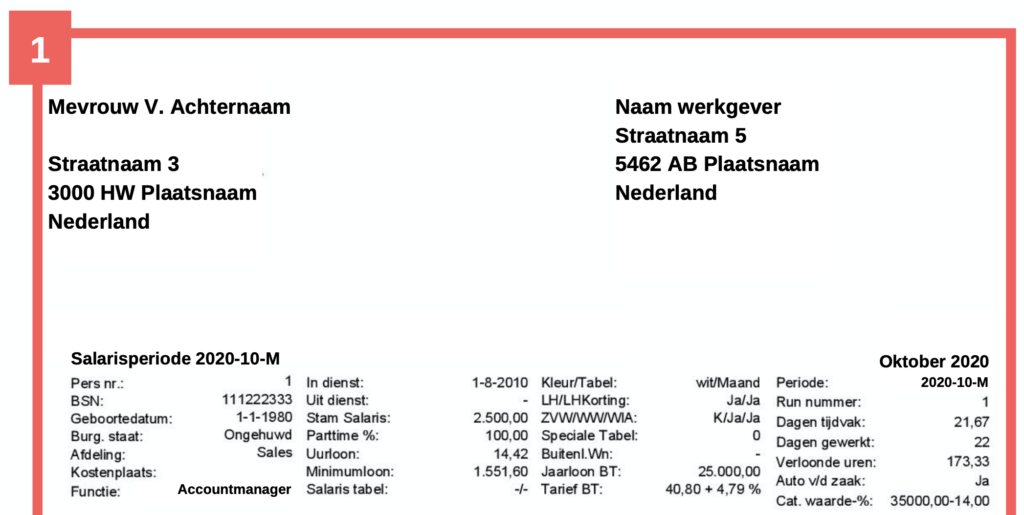

Payslip in the Netherlands explained

Thus, you have to make an appointment with any RDW inspection centres to provide: › your passport or ID. › any vehicle-related documents such as proof that you own the car. › your driving licence. › the BMP exemption letter you received after your application. › your vehicle.

Vehicle Tax

Information on Dutch vehicle import taxes is available on the Netherlands customs bureau (Douane Nederlands) website. Taxes that may be involved in the import process are: BTW - sales tax; BPM - this is a "green" tax payable by the first person to register a car or motorcycle in the Netherlands. This does not apply to the first car for.

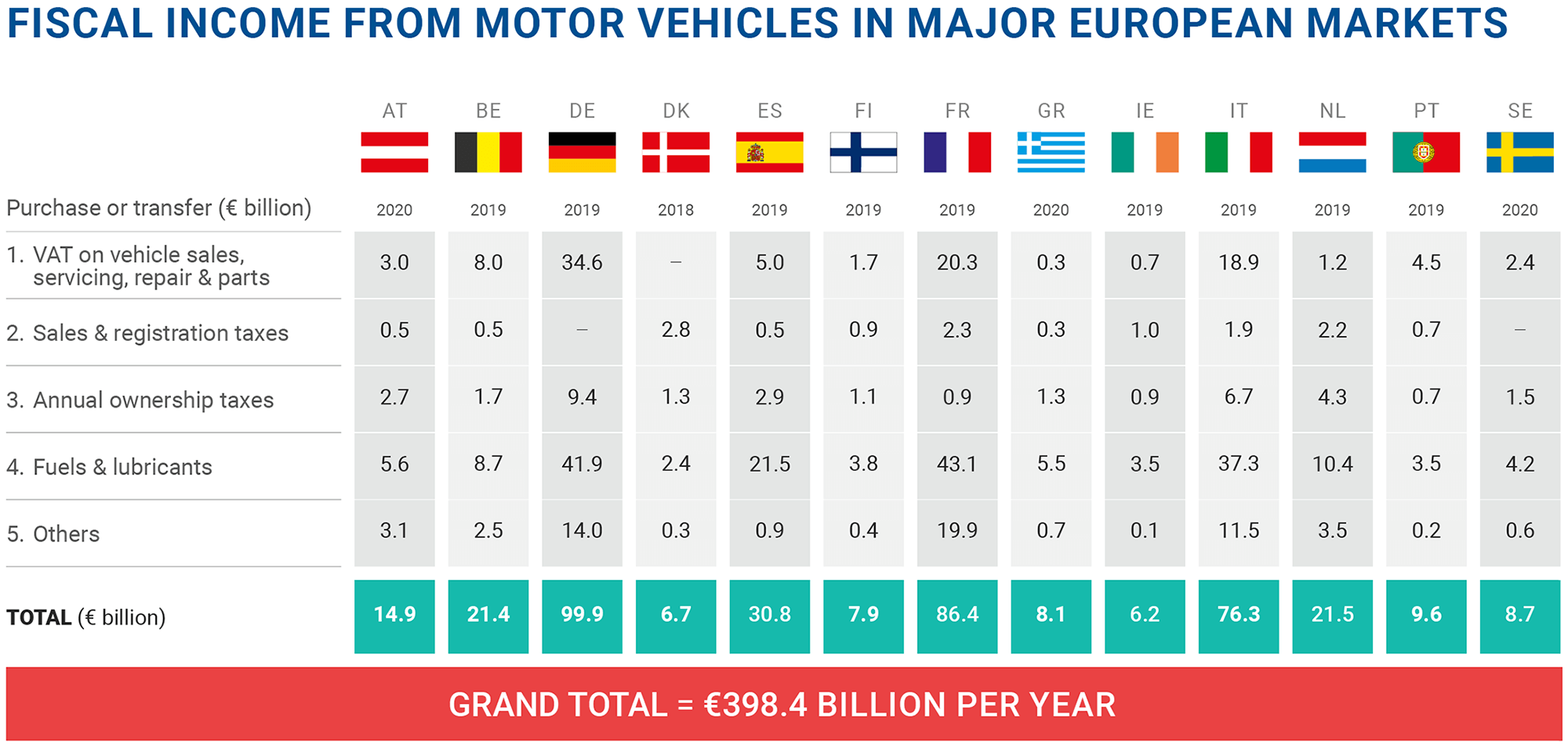

España es el país europeo que menos impuestos recauda por cada coche Marca

In conclusion, tax revenue in the Netherlands is allocated to a wide range of public services and programs aimed at promoting the well-being and prosperity of its citizens. From education and healthcare to social welfare and infrastructure, tax money plays a vital role in sustaining the functioning of society and supporting the common good..

Netherlands Court of Audit reconsider vehicle tax exemptions, refunds and reductions News

Request an exemption from car and motorcycle tax (BPM) and motor vehicle tax (MRB) for short-term use. This exemption will allow you to drive your car on Dutch roads for a maximum of 2 weeks, starting from the day you first enter the country with your car. You do not need to pay any tax on the car during this period.

Why expats pay less taxes in the Netherlands YouTube

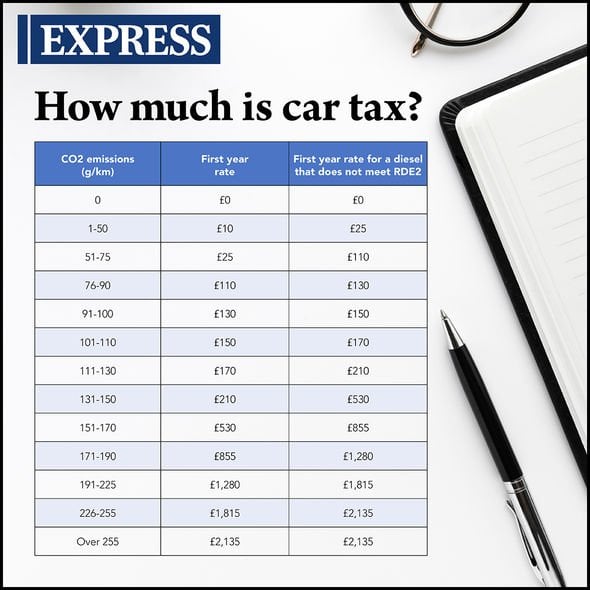

Bpm tariff. The bpm tariff for a passenger car is determined by the CO2 emission. For a delivery van, camper van or motorcycle the bpm tariff is a percentage of the net list price. For a new and unused motor vehicle, the date of registration in the National vehicle licence plate register is decisive for the application of the appropriate tariff.

Dutch taxes explained 30 ruling YouTube

The Dutch tax system is designed to favour cars that are less damaging to the environment and provides incentives for choosing environmentally friendly vehicles. If you decide to go electric, you will need a charging point. Because of the popularity of EVs, there are more and more charging points appearing in Dutch cities. Be sure to only park.

30 tax ruling in the Netherlands Calculation & Explanation

You have to pay motor vehicle tax (MRB). When you register a vehicle registration certificate in your name, you automatically file a motor vehicle tax return at the same time. The Tax and Customs Administration will send you automatically an invoice for motor vehicle tax. For more information on motor vehicle tax, go to the site of the Tax and.

Car tax band rates Complete guide for road tax UK The Auto Experts

Car tax can be seen as a kind of umbrella form of tax, of which road tax is also a part. You pay road tax, as stated earlier, to give the Dutch government room to keep the roads in good condition.. Because in the Netherlands the provinces have the freedom to set the opcent rates themselves, the road tax rate also varies by province. The.

Tax in the Netherlands

Februari 13, 2018. When you buy or import a car to the Netherlands, or when you have a motor vehicle in your name, you pay tax. For lease cars the tax is included in the lease price. The Tax and Customs Administration (Belastingdienst) makes a distinction between three types of tax: Motor vehicle tax, Bpm and Tax on heavy motor vehicles.

30 Dutch Tax Ruling Demystified

Vehicle Tax in NL. Paying Vehicle Tax is a key 'to do', when it comes to driving in NL. Here's what you need to know: 'BPM' is a vehicle tax that you are required to pay on your car or motorcycle, the very first time it is registered in the Netherlands; If you buy a car in Holland, the official car importer will include the tax in the price of the vehicle

Taxation in the Netherlands Doing business in the Netherlands 2020 PwC Netherlands

Buying a car in the Netherlands. The Netherlands may be known as a land of bicycles, but cars are not far behind.In fact, according to data from 2023, there are 8.9 million passenger cars on the road.This represents one for every 1.9 inhabitants. Figures also show that car ownership has been increasing since 2020, with a growth of around 100,000 per year.