Turnover Ratios Definition, All Turnover Ratios, Uses & Importance eFM

Putting it all together - the best way to pay yourself as a director. Taking all the above taxes together, in the 2023/24 and 2024/25 tax year, it's usually tax-efficient for most limited company directors to take a monthly salary up to the NI Secondary threshold of £758.33 per month, or £9,100 per year. As we mentioned at the start of this.

How Understanding Accounts Payable Turnover Helps Your Business

The biggest difference from a legal perspective is that, operating as a limited company, you and your business are distinct legal entities. Profit and expenses come in and out of your business's bank account, not yours. This extra layer of separation means that if things should go pear-shaped and you go bust, you only stand to lose what you.

:max_bytes(150000):strip_icc()/TermDefinitions_WorkingCapitalTurnoverRatio-6717af60fcaf42f8a7739b134dddf1ff.jpg)

Working Capital Turnover Ratio Meaning, Formula, and Example

New threshold limits of 'capital' and 'turnover' for small companies. On September 15, 2022, the Ministry of Corporate Affairs notified the Companies (Specification of Definition Details.

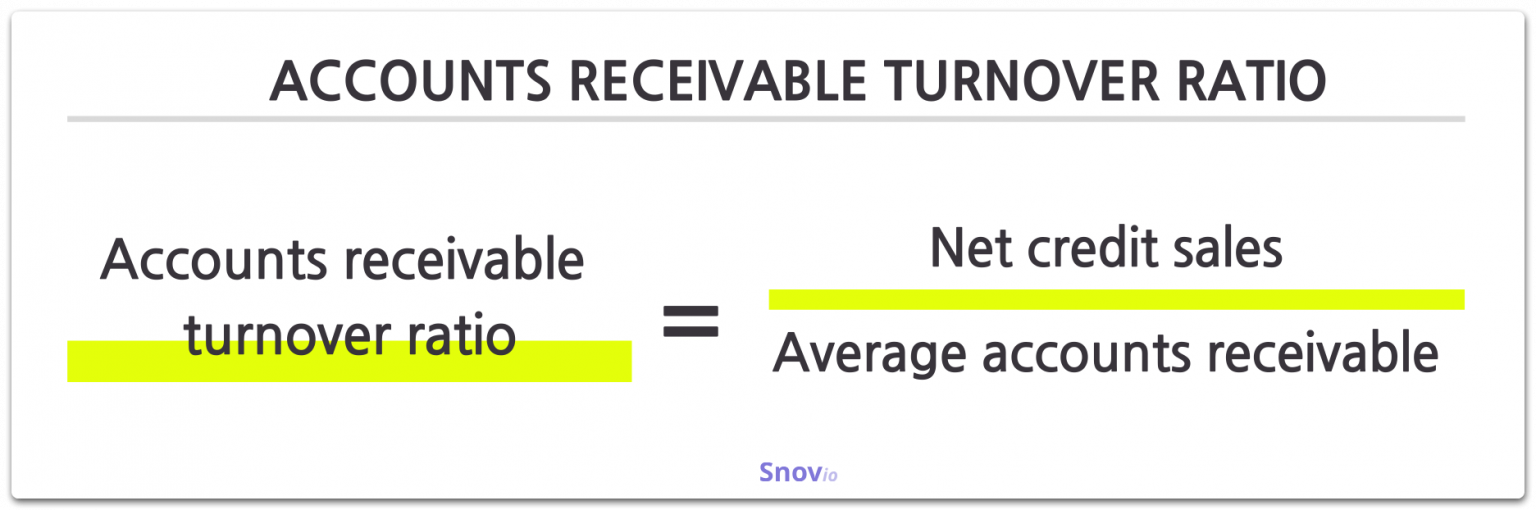

What is Sales Turnover Definition and ratio formulas Snov.io

A private limited company, often abbreviated as Pvt Ltd, is a type of business entity that is privately held and offers limited liability to its shareholders. This article delves into the requirements for setting up and maintaining a private limited company, with a specific focus on whether a minimum turnover is a prerequisite in various.

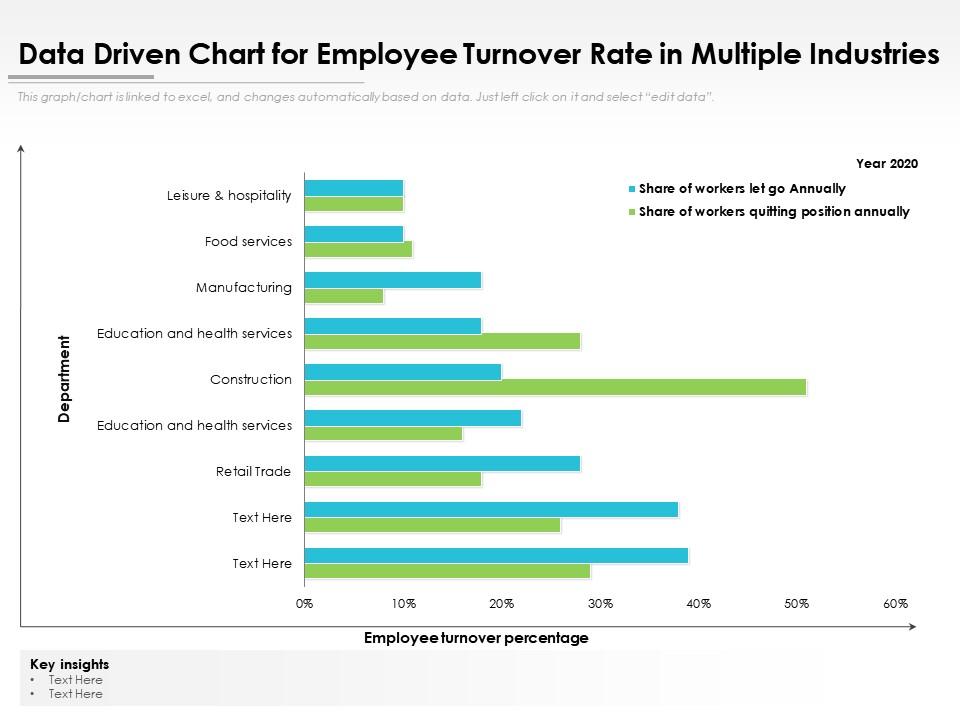

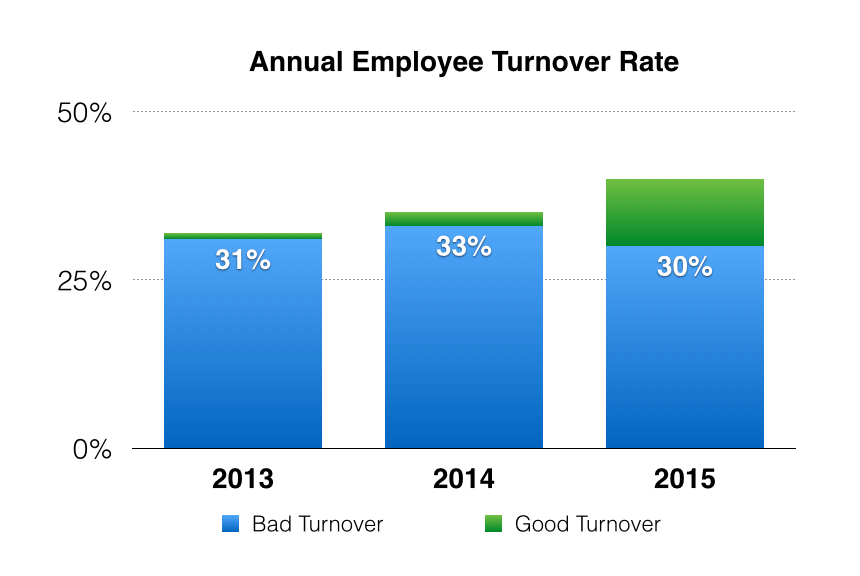

Data Driven Chart For Employee Turnover Rate In Multiple Industries Presentation Graphics

A limited company has its own assets and liabilities, profits and losses. The liabilities are limited to the Company. In other words, the officers are protected from financial liability should the company encounter any difficulties. This differs from those of a sole trader or partnership, where the assets and liabilities of the business belong.

SME Definitions in Terms of Annual Sales Turnover Download Table

A minimum of one director, nevertheless, must be an Indian national. Shareholders: Two shareholders are required to form a private limited business. But no more than 200 will do. Minimum Capital Requirement: It costs ₹100,000 to start a private limited business. That rule was taken away in 2015.

What is Sales Turnover Definition and ratio formulas Snov.io

What is the minimum turnover for a Pvt Ltd company? There is no minimum turnover prerequisite for a Pvt Ltd company in India. However, certain threshold limits under the Companies Act 2013 trigger different compliances for Pvt Ltd companies, such as certification of annual return, corporate social responsibility, internal audit, appointment of auditor, etc.

Does Your Customer Service Team Have a Turnover Problem? — Jeff Toister

The concept of minimum turnover requirements stands as a crucial cornerstone for Limited Companies. These requirements, often abbreviated as MTRs, play a pivotal role in defining a company's economic viability, regulatory compliance, and positioning within the market. Minimum turnover requirements refer to the stipulated level of revenue that.

What is the minimum turnover for GST? Indiafilings

Minimum tax on turnover. Where the tax payable by a company is less than 1.25% of the turnover, the company is required to pay a minimum tax equivalent to 1.25% of the turnover, except where the company is exempt from levy of minimum tax. In certain cases/sectors, such turnover tax is payable at rates less than 1.25% (ranging from 0.25% to 0.75.

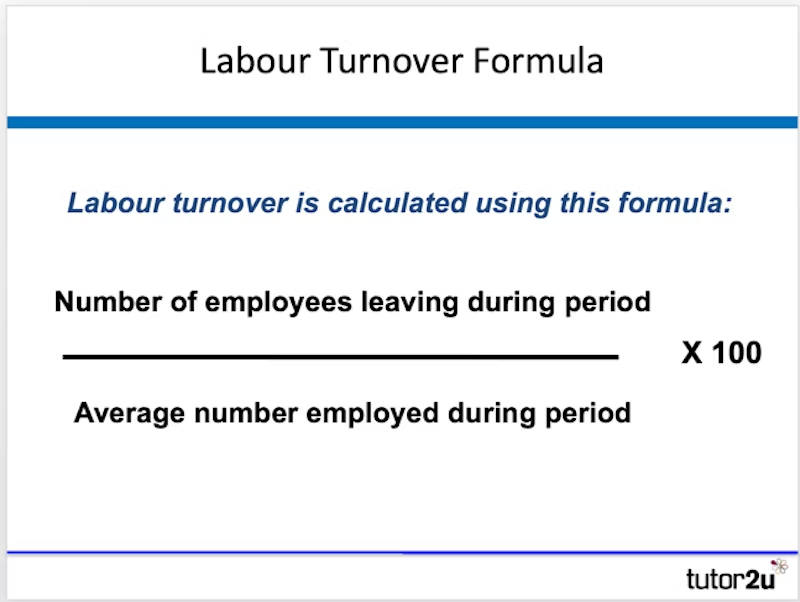

Labour turnover Reference Library Business tutor2u

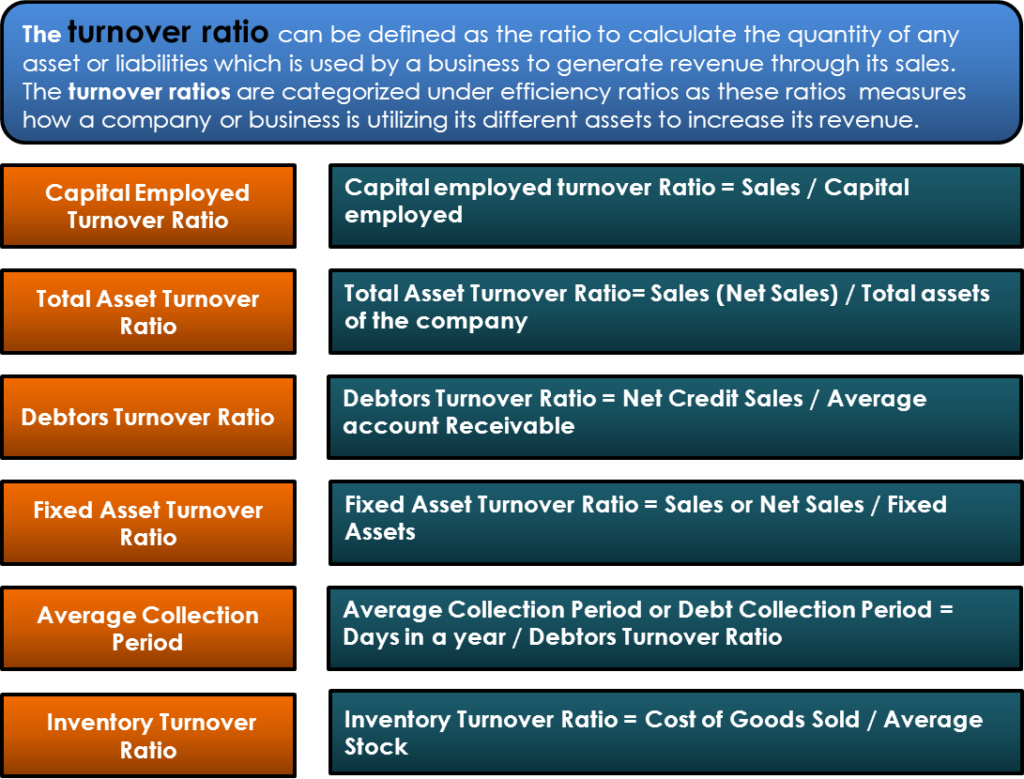

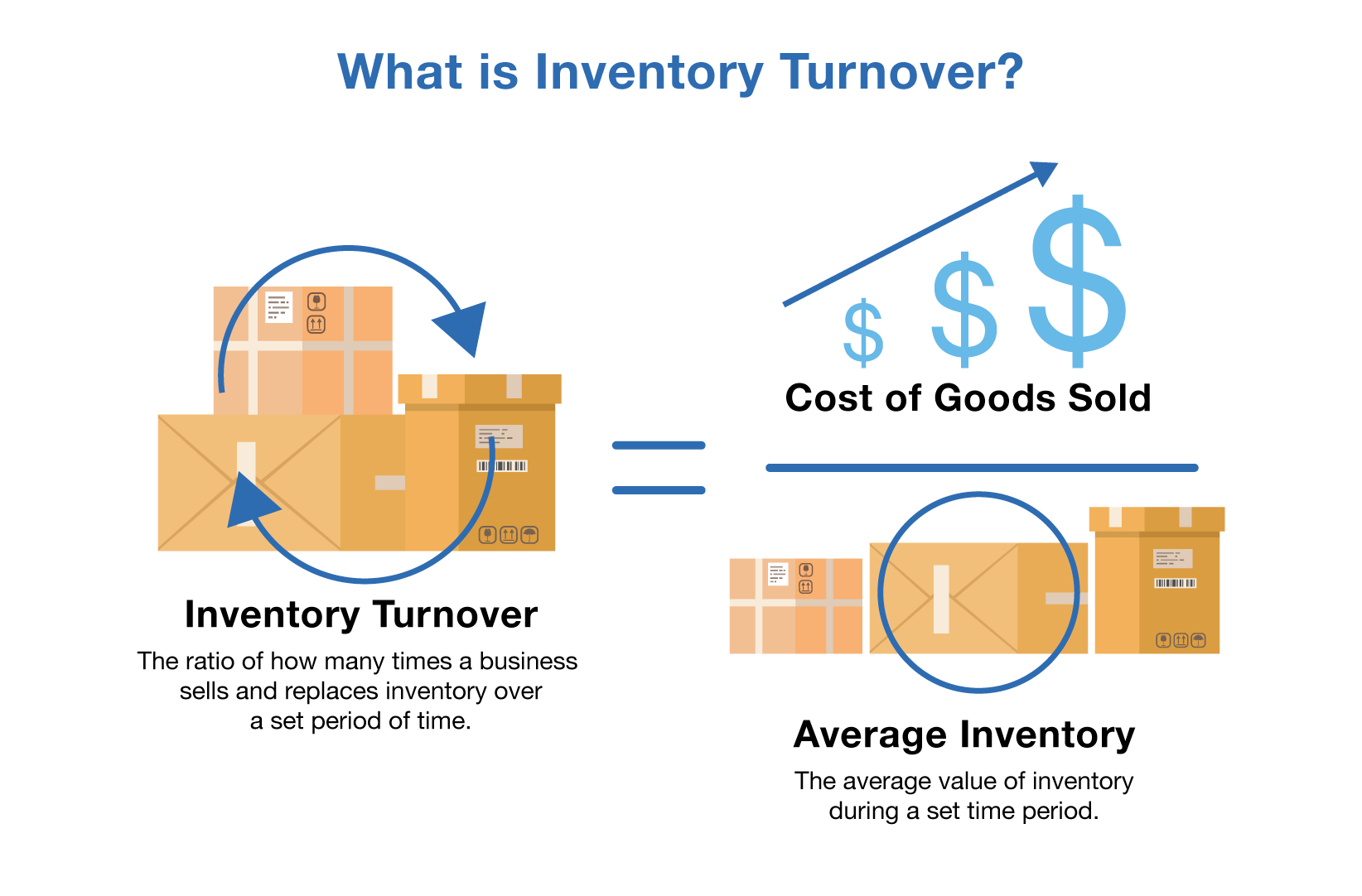

Turnover is an accounting term that calculates how quickly a business collects cash from accounts receivable or how fast the company sells its inventory.

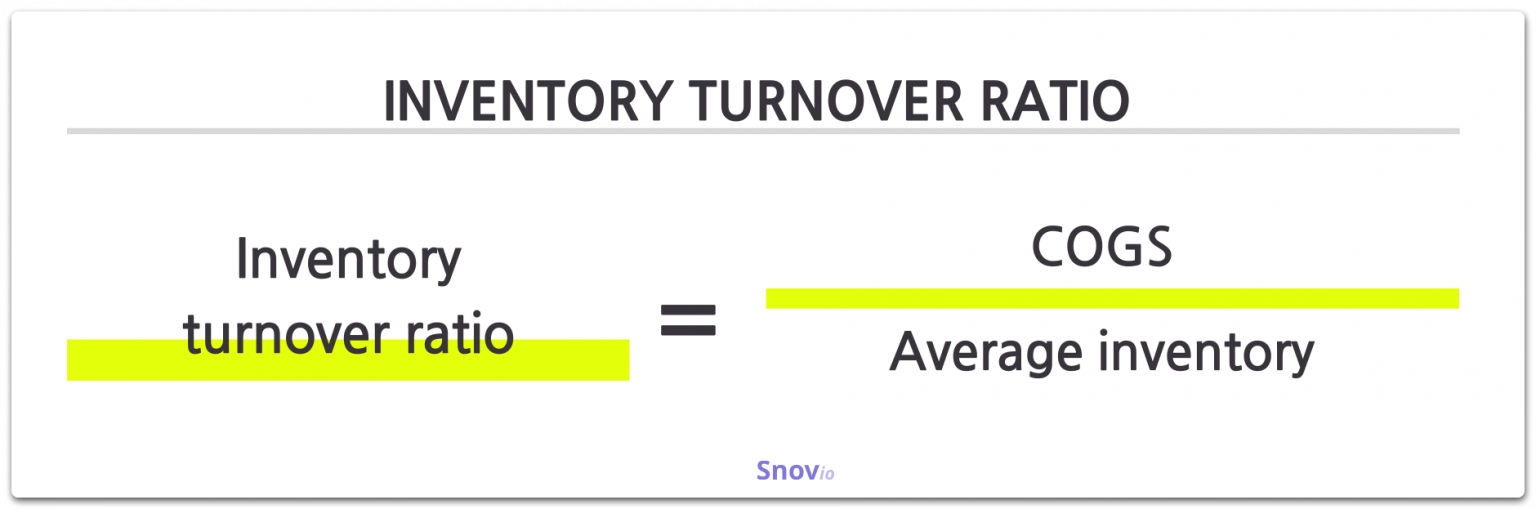

Inventory Turnover Ratio, Definition & Formula

By Shreya Durgan. Starteazy. Minimum turnover for Pvt Ltd Company is the minimum revenue it should make to be considered operational by the government. It is calculated as the total turnover of a company in a year, divided by the number of days it's been operating. There is no minimum turnover requirement for Pvt Ltd Company in India.

8 Employee Retention Metrics You Need to Measure

This section provides various conditions which, if a business fulfils, it becomes necessary for it to obtain a Goods and Service Tax Registration. The minimum turnover for GST is 40 lakh rupees for goods and 20 lakh rupees for services category. If an entrepreneur makes a taxable supply of goods and services or both and the aggregate turnover.

Minimum Tax Calculation, turnover and its exclusions YouTube

At a glance. Sole trader or partnership. Limited company: you are director & shareholder. You are the business. The business is a separate legal entity to it's shareholders and directors. You are the owner. You are a shareholder; you hold all or part of the company's share capital. You are the manager or proprietor.

How to calculate staff turnover [+ free online calculator]

As per Lawkidunya, the minimum tax on turnover means, where the tax payable by a company is less than 1.25% of the turnover, the company is required to pay a minimum tax equivalent to 1.25% of the turnover.In certain cases/sectors, such turnover tax is payable at rates less than 1.25% (ranging from 0.25% to 0.75 % of turnover). Rs.2.00 Crores

Minimum turnover for a business loan

Why a low income businesses should become a limited company. A sole trader with a profit below the personal allowance and the Class 4 National Insurance lower limit will not be liable to pay any tax, but if they earn above the small earnings exception (£6,025 for 2017/18 and £5,065 for 2016-17), then they will be liable to pay Class 2 NI.

What is Turnover Rate? HR Glossary Xobin Blog

To be honest, there is no statutory minimum or recommended turnover for forming or operating a limited company in the United Kingdom. Companies can be established and continue to operate regardless of their turnover, and the UK government does not set a specific minimum turnover threshold for company formation or operation.