tax rates in Holland and Finland

Netherlands, like all EU member countries, follows the EU VAT Directive on VAT compliance. However, it is still free to set its own standard (upper) VAT rate. The only proviso is that it is above 15%. Suppliers of goods or services VAT registered in Netherlands must charge the appropriate VAT rate, and collect the tax for onward payment to the.

VAT rates applied in the Member States of the European Union Download Table

In the Netherlands, entrepreneurs must file Value Added Tax returns (btw aangifte) with the Netherlands Tax Administration. In the VAT return, you declare the VAT you have charged your customers. You deduct the VAT that your suppliers have charged you. You must submit your VAT returns digitally and on time, to avoid an extra or assessment or fine.

ValueAdded Tax (VAT) Bases in Europe Tax Foundation

If these conditions have been met, this supply is taxed with 0% VAT (the 0% rate). Even if you transfer your own goods from the Netherlands to another EU country you perform an intra-Community supply in the Netherlands. This supply is taxed in the Netherlands with 0% VAT. In the country of destination you pay the VAT.

The Dutch VAT (BTW) explained YouTube

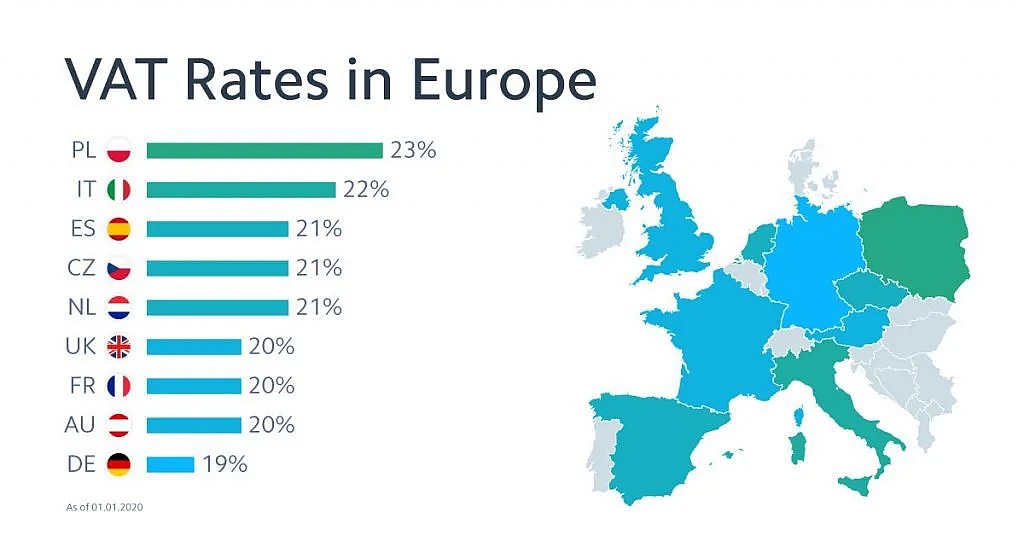

What is the Standard VAT Rate in The Netherlands? 21%. Standard VAT Rate: 21%. The standard VAT tariff also called the high or general tariff, applies to the supply of goods and services ( article 9 (1) of the OB 1968 ), importation of goods and intra-Community acquisitions of goods where there are no relevant exemptions.

Webinar snippet The Dutch VAT rates Starting a business in the Netherlands YouTube

5.2 The VAT rate is 0%, 6% or 19%. If a supply is not exempt and is also not subject to the reverse-charge mechanism, it is automatically taxed at one of three possible rates. The following sections explain the situations in which these rates apply. .

VAT in the Netherlands All VATRelated Information and Services in One Place

The standard VAT rate in The Netherlands is 21% and applies to most goods and services. The reduced rate is 9% and applies to some foodstuffs, some medical products and equipment for the disabled, books, newspapers, admission to cultural and sports events, the hospitality sector, clothing and shoes. Dutch zero-rated goods and services include.

Netherlands increases VAT rate to 21 1 October 2012

Read in: 5 min. VAT (value-added tax), the tax on goods and services, was introduced in the Netherlands in 1969 and was set at 12%. Currently, the standard VAT rate in the Netherlands stands at 21%, with some products and services subject to reduced rates of 9% and 0%. In the following article, we will cover the most important VAT-related.

2023 global VAT rate changes

Rates: 21%, 9% or 0%. In the Netherlands, the standard VAT rate is 21%. There are two additional special rates: the 9% rate and the 0% rate (zero rate). Summary of tax rates at Belastingdienst.nl. The Tax and Customs Administration website provides information on the different VAT rates. VAT exemptions. Some goods and services are exempt from VAT.

VAT Registration Netherlands 2024 Guide

VAT relating to purchase and sale of goods. You will be involved with VAT both in the purchase and sale of goods. For example, if you buy goods in the Netherlands or if you export goods out of the Netherlands.

The Netherlands Composition of the VAT Base in 2010 Download Table

VAT-related penalties in the Netherlands. A fine between 68 and 136 euros per declaration. A fine of 3% of the VAT due with a minimum of 50 euros and without exceeding 5514 euros. A fine of : 136 euros for the first non-deposit; 275 euros for the second and third non-deposit; 1378 euros for the following non-deposits.

The Dutch VAT accounting software for VAT Invoicing & bookkeeping

Dutch VAT penalties. In the case of incorrect VAT declarations or late submission of Dutch VAT returns, foreign companies may be subject to penalties of up to €4,920. Interest is calculated on the outstanding VAT. The rate is updated by the Tax Department twice a year and is currently set at 4% annually.

VAT Calculator Netherlands December 2023 VAT Rate is 21

Caribbean Netherlands (Bonaire, Sint Eustatius, and Saba) The Caribbean Netherlands employ an Expenditure Tax (Algemene bestedingsbelasting or ABB) instead of a VAT system. The general ABB rate is 8% for goods and 6% for services. Special rates apply to specific items, such as 7% for insurance services and 25% for cars with CO-2 emissions.

VAT Registration The Netherlands First VAT All VAT services at one place

The rate of the import VAT is the same as the usual VAT rate in the Netherlands (standard rate 21%, reduced rate 9%). However there are also ways to defer the payment of import VAT in the Netherlands.

Chart Mind The Gap Uncollected VAT Cost The EU €140 Billion In 2018 Statista

In principle, there are two VAT rates in the Netherlands: 21%, the "standard rate"; and. 9%, the "reduced rate". Additionally, companies providing goods or services from the Netherlands to other countries often have to apply a 0% rate. Below we provide you with a general overview of the (use of the) different VAT rates in the Netherlands.

Netherlands Inflation Rate Everything You Need to Know

There are 3 VAT tariffs in the Netherlands: 0% tariff; 9% tariff; 21% tariff; 0% tariff. The 0% tariff applies to entrepreneurs who conduct business abroad from the Netherlands. This mainly involves the supply of goods from the Netherlands to another European Union (EU) Member State. However, the 0% tariff also applies to some services that are.

Stawki podatku VAT w Europie, 2020

The Dutch VAT regime (btw, omzetbelasting) has 3 rates : 0%, 9% and 21%. In some instances businesses are exempt from VAT and in some cases there are special arrangements regarding VAT. VAT rates 0% rate. If you are based in the Netherlands and you do business in other countries, the 0% VAT rate may apply.

- Nissi Beach Ayia Napa Cyprus

- социална пенсия с 15 години трудов стаж

- Hoe Ziet Een Harde Schijf Eruit

- Jan Uit B En B Vol Liefde

- Betekenis Witte Vlinder In Tuin

- Jermaine Jackson And Whitney Houston

- Almost Is Never Enough Lyrics

- Fc Internazionale Ac Milan

- Ben Mendelsohn Movies And Tv Shows

- Welke Satelliet Voor Nederlandse Zenders