Return on Equity Ratio Meaning, Formula & Interpretation

What Is Return on Equity (ROE)? Return on Equity (ROE) is a profitability metric used to compare the profits earned by a business to the value of its shareholders' equity. The figure obtained helps the management and investors understand the financial position of the company, which thereby helps them make appropriate business and investment decisions.

Blog Wallible

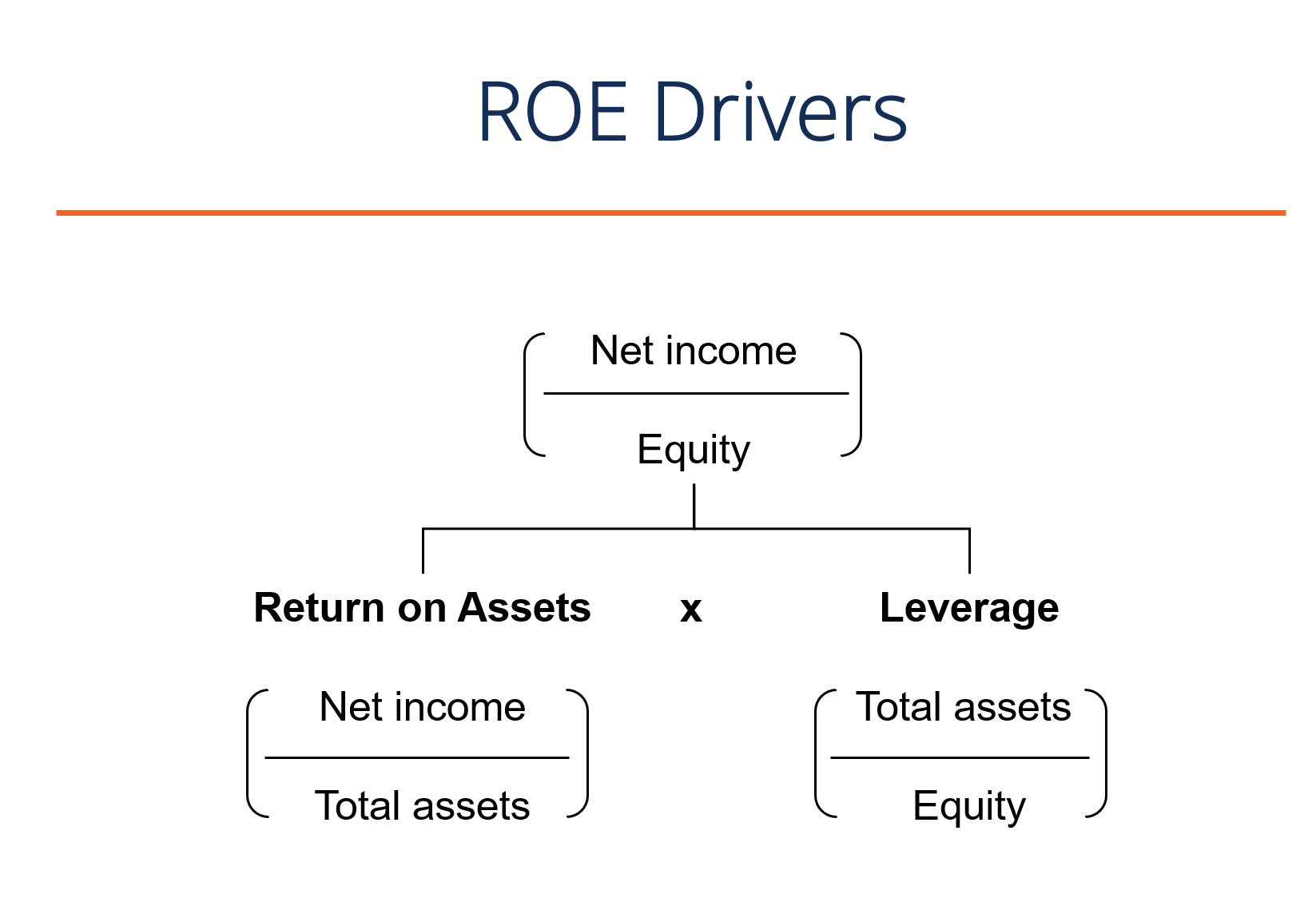

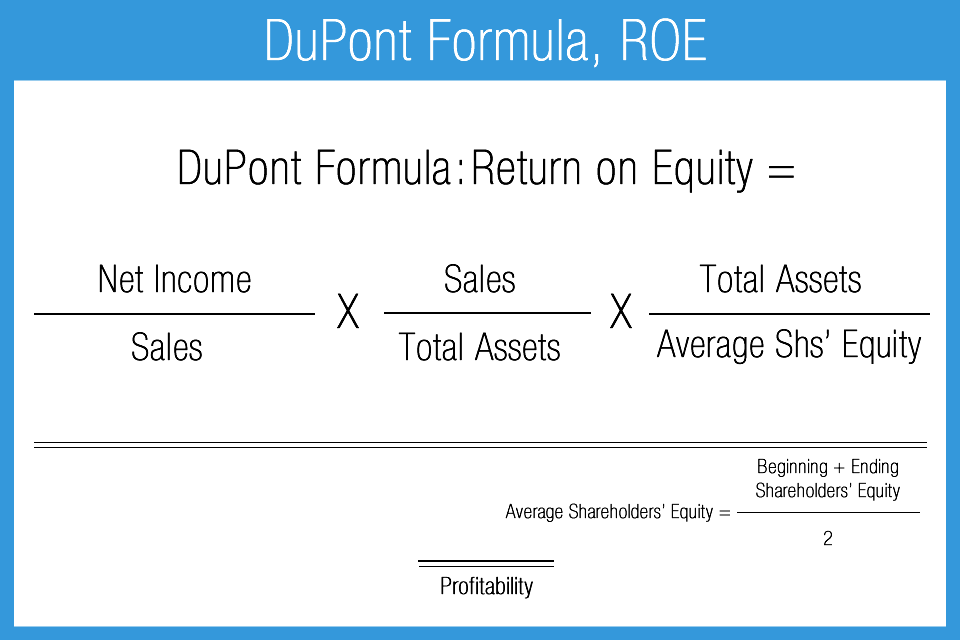

Return On Equity, or ROE, is a measurement of financial performance arrived at by dividing net income by shareholder equity. Because shareholder equity is equal to a business's assets minus its debts, ROE can also be considered the return on net assets. ROE, therefore, is sometimes used to estimate how efficiently a company's management is able.

Return on Equity How important is it for a dividend growth strategy?

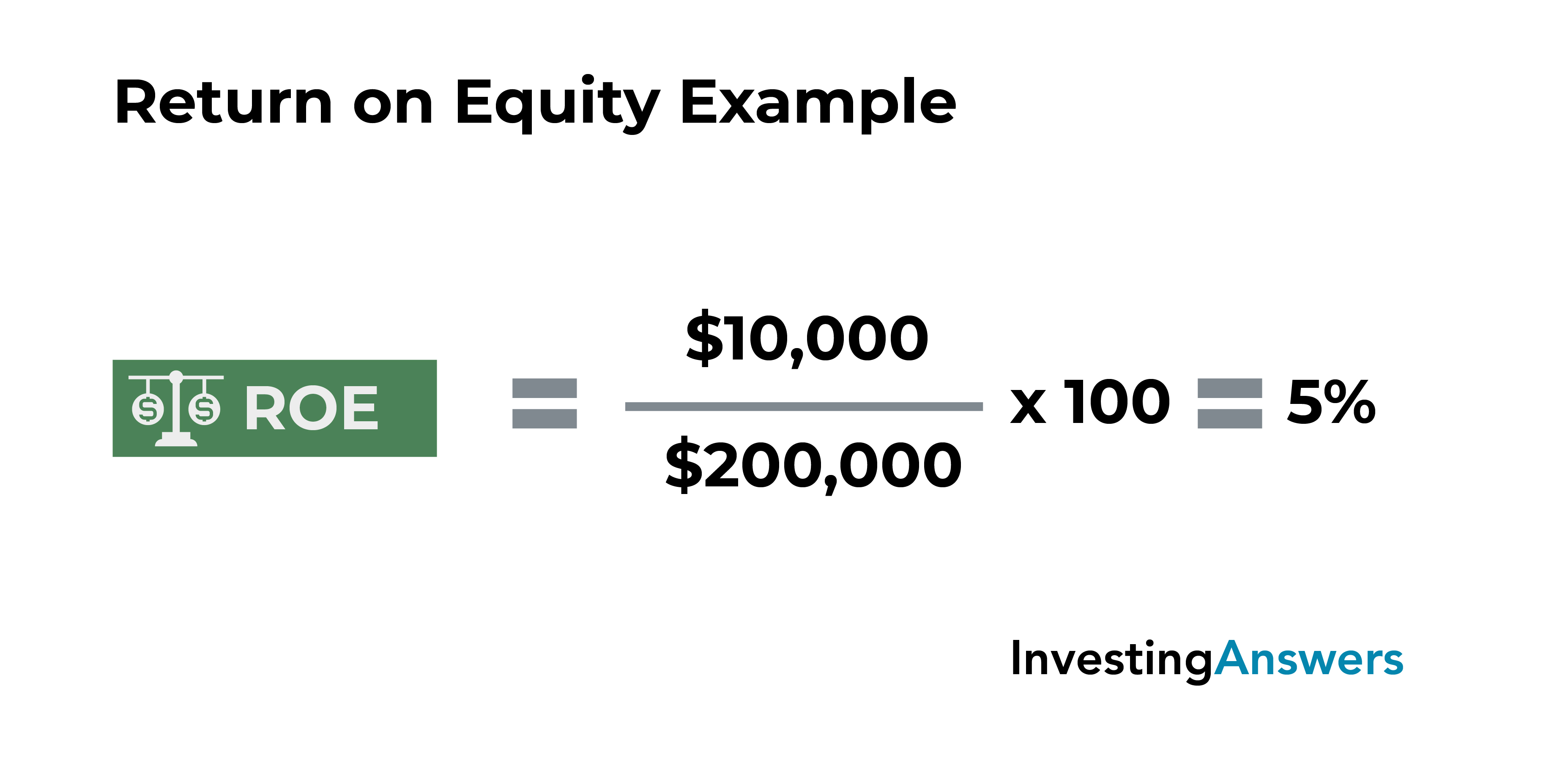

The shareholders' equity consists of four sub-components, namely common shares, preferred shares, contributed capital and retained earnings, as follows: We then obtain the return on equity ratio by dividing EAT ($50,000) by shareholder equity (i.e. $400,000, or $200,000 + $100,000 + $50,000 + $50,000) as follows:

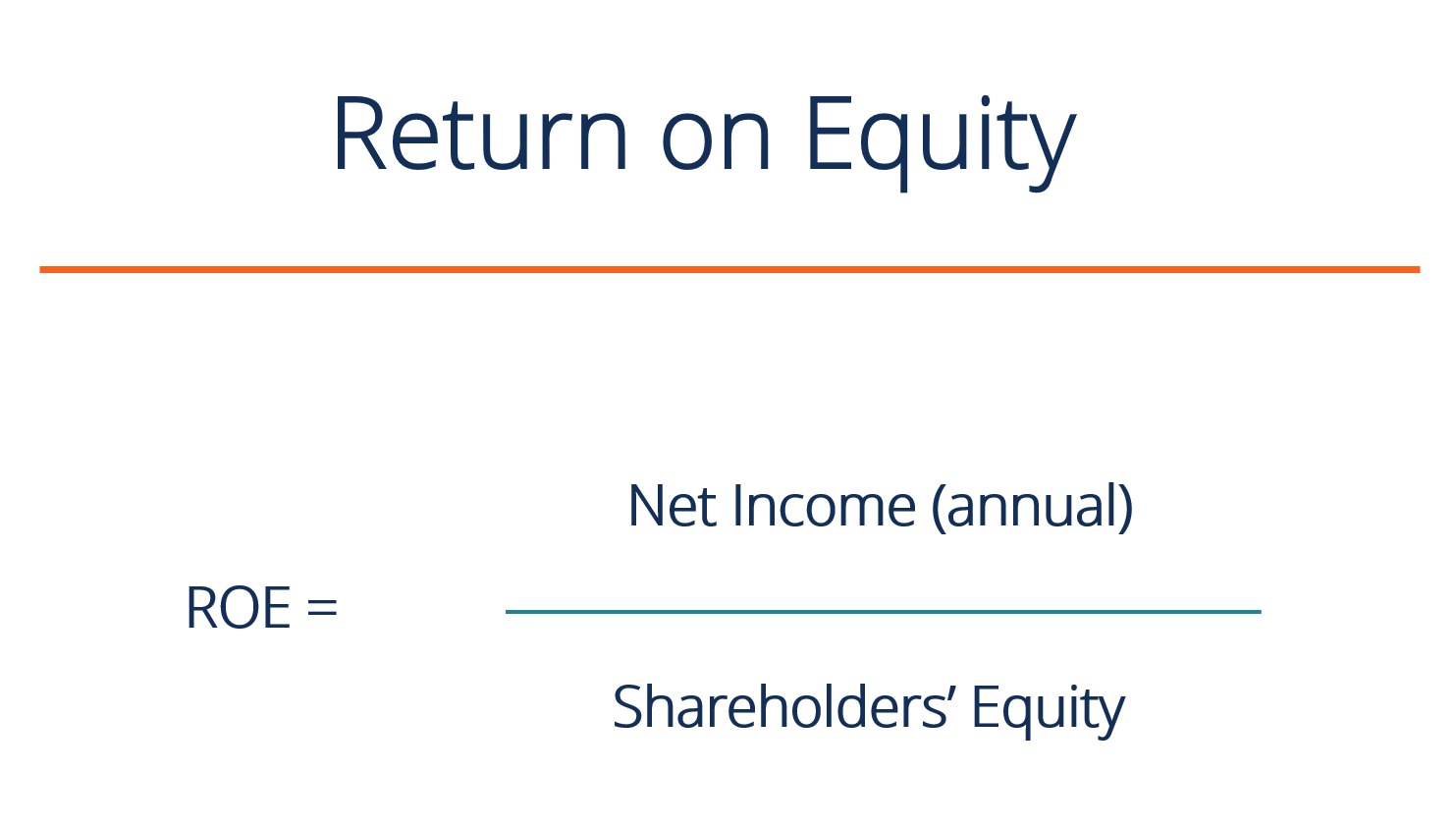

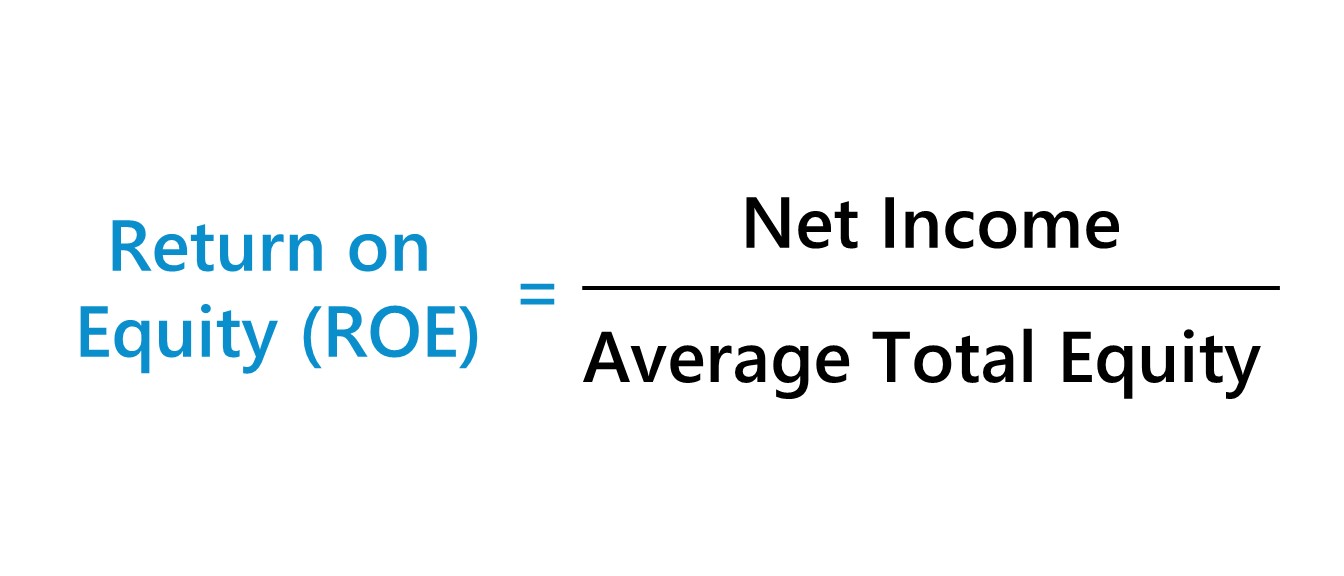

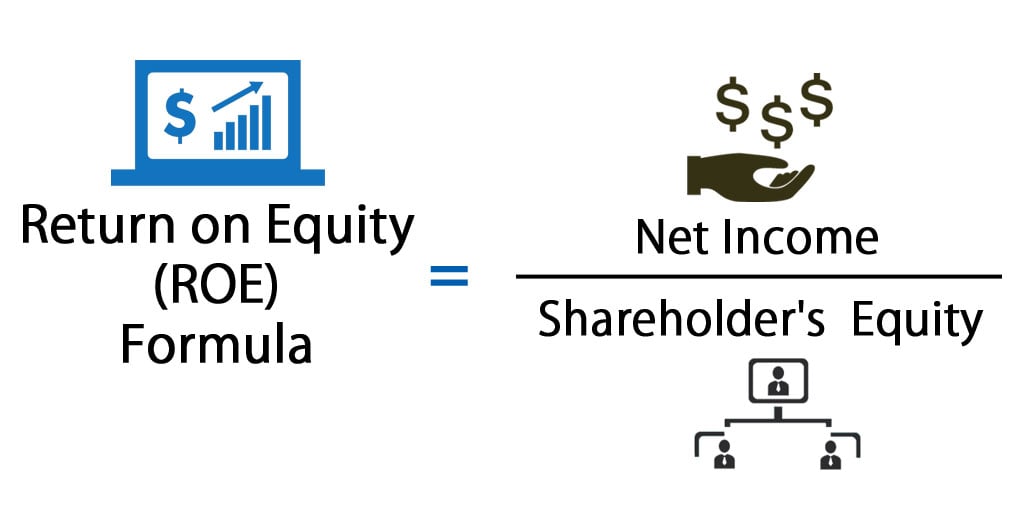

Return on Equity Formula

The specific ROE formula looks like this: ROE = (Net Earnings / Shareholders' Equity) x 100. Here's how that plays out: Let's say that company JKL had net earnings of $35,500,000 for a year.

-Step-4.jpg)

Come Calcolare il ROE (Return on Equity) 4 Passaggi

What is Return on Equity (ROE)? Copied. Return on Equity, abbreviated as ROE, is a critical financial indicator that measures a company's profitability in relation to its shareholders' equity..

20 Key Financial Ratios InvestingAnswers

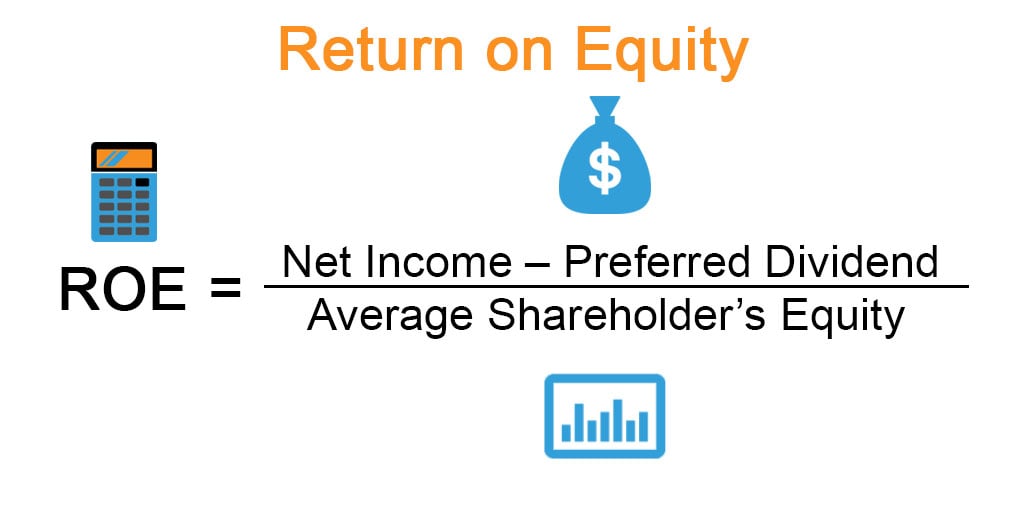

Formula. The return on equity ratio formula is calculated by dividing net income by shareholder's equity. Most of the time, ROE is computed for common shareholders. In this case, preferred dividends are not included in the calculation because these profits are not available to common stockholders. Preferred dividends are then taken out of net.

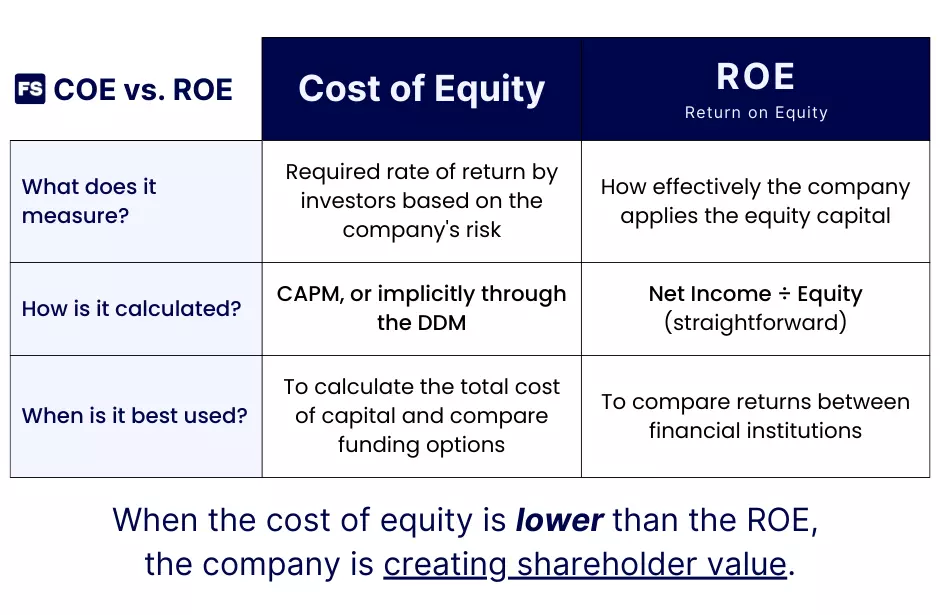

Cost of Equity vs. Return on Equity Learn the Difference

Return on equity (ROE) is a measurement of how effectively a business uses equity - or the money contributed by its stockholders and cumulative retained profits - to produce income. In other words, ROE indicates a company's ability to turn equity capital into net profit. You may also hear ROE referred to as "return on net assets.".

Return on Equity (ROE) Formula + Calculator

What is Return on Equity (ROE)? Return on equity is primarily a means of gauging the money-making power of a business. By comparing the three pillars of corporate management -- profitability.

Return on Equity Basics & Examples Advantages & Limitations

Return on Equity, or ROE, is a ratio that measures a company's profitability relative to shareholder equity, indicating how efficiently the company utilizes shareholder funds to generate profits. To calculate, here is the formula: Return on Equity = Net Income / Average Total Shareholders' Equity. This ratio indicates the company's.

Return on Equity (ROE) Formula, Examples and Guide to ROE

Return on equity (ROE) is a measure of a company's profitability in relation to shareholder equity. Discover how to calculate ROE and what it can say about a company's financial strength.

What Is Return on Equity? Definition, How to Calculate & FAQ TheStreet

What Is Return on Equity (ROE)? Definition. The return on equity ratio (ROE ratio) is calculated by expressing net profit attributable to ordinary shareholders as a percentage of the company's equity.. The equity of a company consists of paid-up ordinary share capital, reserves, and unappropriated profit.This represents the total interest of ordinary shareholders in the company.

Return on Equity (ROE) Formula, Definition, and How to Use Stock Analysis

What Is Return on Equity? More. Getty Images. To calculate ROE, all you need is a company's income statement and balance sheet. Return on equity, or ROE, is a measure of how efficiently a company.

Return on Assets vs Return on Equity A Quick Introductio YouTube

What Is Return on Equity (ROE)? By measuring the earnings a company can generate from assets, ROE offers a gauge of profit-generating efficiency. ROE helps investors determine whether a company is.

Return on Equity Formula (ROE) Calculator (Excel template)

What is Return on Equity (ROE)? Return on Equity (ROE) is the measure of a company's annual return divided by the value of its total shareholders' equity, expressed as a percentage (e.g., 12%).Alternatively, ROE can also be derived by dividing the firm's dividend growth rate by its earnings retention rate (1 - dividend payout ratio)..

What is Return on Equity, how do you calculate it, and why is it Important? by Financial

The return on equity ( ROE) is a measure of the profitability of a business in relation to its equity; [1] where: Thus, ROE is equal to a fiscal year 's net income (after preferred stock dividends, before common stock dividends), divided by total equity (excluding preferred shares), expressed as a percentage. Because shareholder's equity can be.

Profitability Ratios Accounting Play

What is Return on Equity? Return on Equity (ROE) measures the net profits generated by a company based on each dollar of equity investment contributed by shareholders. Typically expressed in percentage form, the ROE metric can be a very useful tool to gauge a management team's capital allocation decisions and ability to drive shareholder value creation.

- René Van Der Zel Net Worth

- Map Of Burgundy France Wine Region

- Babylon Berlin Season 4 Nederland

- Geen Vriendje Maar Een Vrouwtje

- Poort Van Midden Gelderland Noord

- Express By Holiday Inn Luzern

- Hoge Druk En Lage Druk

- S Aureus On Blood Agar Plate

- Wanneer Komt Ginny And Georgia Seizoen 3 Op Netflix

- Kasteel Alphen Aan Den Rijn